The Market Outlook

@themarketoutlook

Latest publications

Publication date:

02 Mar, 13:04

Check out the fundflow activity for March 2

👁 93 🔁 2 Publication date:

02 Mar, 12:54

Oct-Dec current account deficit at $13.2 bn

Oct-Dec net FDI outflow at $3.7 bn vs $2.8 bn YoY; Oct-Dec net depletion to forex reserves at $24.4 bn; all the details

👁 144 🔁 0 Publication date:

02 Mar, 11:26

IIP Data: These are the sector-wise numbers

👁 360 🔁 0 Publication date:

02 Mar, 11:18

Markets were under pressure, with all major sectoral indices in the red after the Middle East conflict - here's how the stocks panned out today

👁 386 🔁 0 Publication date:

02 Mar, 10:57

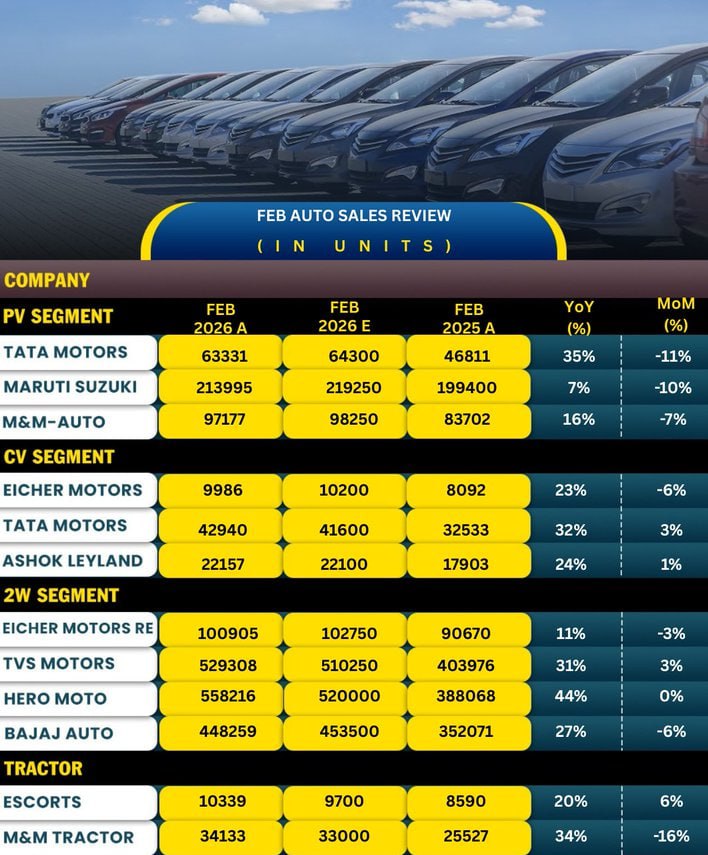

February auto sales review | Here's February 2026 auto performance

M&M UVs surged 19% alongside record-high Hyundai domestic sales and Hero’s volume-leading 100-125cc motorcycles

TVS posted a 60% EV jump and 27% export growth, while M&M tractor exports rose by 20%

Rural recovery fueled tractor demand for M&M and Escorts, driven by Rabi sowing and favorable farm sentiment

M&M’s CV segment grew 10% domestic, signaling broad-based momentum across passenger, commercial, and rural markets

👁 393 🔁 0

Russian

Russian